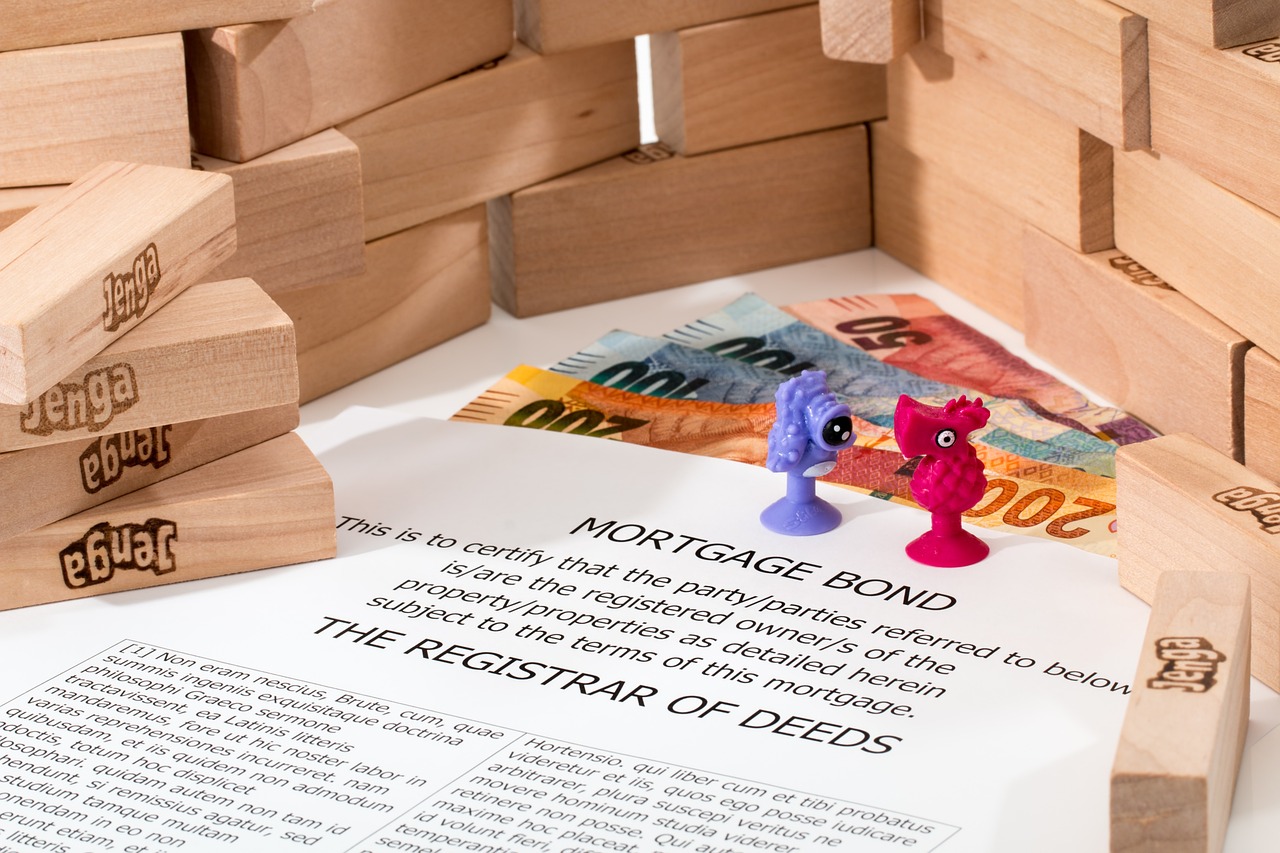

The Ultimate Guide to Understanding Current Mortgage Rates

Introduction Understanding mortgage rates is essential for anyone embarking on the journey of homeownership or considering refinancing their existing mortgage. Mortgage rates play a pivotal role in determining the affordability of a home purchase and the overall cost of borrowing. In simple terms, mortgage rates represent the interest charged by lenders on the amount borrowed … Read more